Loading...

ComplyRight 1095-C Tax Forms Set, Employer-Provided Health Insurance Offer And Coverage Forms with Envelopes, Laser, 8-1/2" x 11", Set For 100 Employees

Product #:

CPRAC1095E300

Sold Out

This product is sold out and we do not know when we will be getting another shipment. We apologize for any inconvenience this may cause.

Check similar items above to see if a replacement product is available.

Product Description

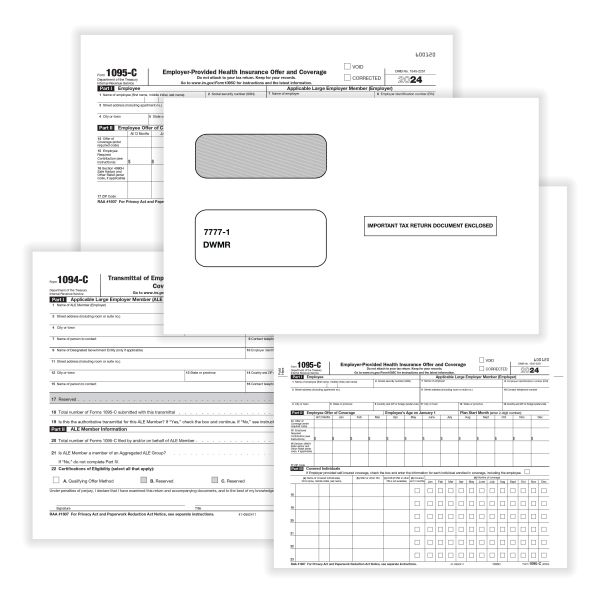

ComplyRight 1095-C Tax Forms Set, Employer-Provided Health Insurance Offer And Coverage Forms with Envelopes, Laser, 8-1/2" x 11", Set For 100 Employees

Employers with 50 or more full-time employees (including full-time equivalent employees) in the previous year use Forms 1094-C and 1095-C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage for their employees. Form 1094-C must be used to report to the IRS summary information for each applicable large employer (ALE) and to transmit Forms 1095-C to the IRS. These forms are also used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H. Form 1095-C also is used in determining the eligibility of employees for the premium tax credit.

Product Specifications

-

Brand NameComplyRight

-

Depth11

-

Length11

-

Overall Width8-1/2

-

Packaged Quantity100

-

Product TypeLaser

-

Quantity100

-

Quantity Per Container100

-

Width8-1/2